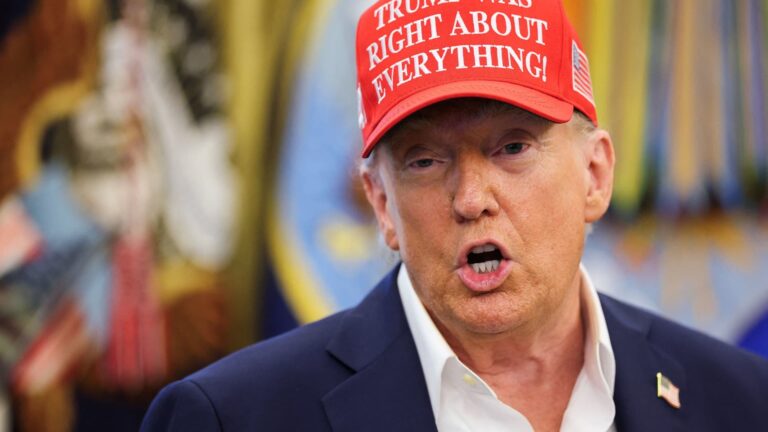

U.S. President Donald Trump wears a ‘Trump Was Right About Everything!’ hat, in the Oval Office at the White House in Washington, D.C., U.S., August 22, 2025.

Jonathan Ernst | Reuters

“State-owned enterprise” is a term you wouldn’t normally bandy about when mentioning the United States — especially not with the country’s Republican party, which has been associated with a laissez-faire approach to businesses and the economy.

If White House gets it way, however, it appears that the government’s 10% stake in Intel is just the start. U.S. President Donald Trump in a Truth Social post signaled favoring companies that strike similar “lucrative” deals with the government.

Earlier in the day, Kevin Hassett, Trump’s economic advisor, told CNBC that “at some point there’ll be more transactions, if not in this industry then other industries.”

Even though Intel’s stock popped when news of the deal broke, the chipmaker in a filing on Monday warned that its agreement with the Trump administration could draw “adverse reactions” from investors, customers and foreign governments.

That’s not an unwarranted fear: Recall how China has been urging its local companies to avoid Nvidia chips amid the chipmaker’s revenue-sharing deal with Washington, or how consumers have steered away from Elon Musk’s Tesla because of his stint in the White House.

Perhaps, it isn’t so much “state-owned enterprises,” but “Trump-associated enterprises,” that might be fueling investor worries.

— CNBC’s Jeff Cox contributed to this report

What you need to know today

More deals like Intel’s to come, Trump says. Earlier Monday, White House economic advisor Kevin Hassett said the move is part of a strategy to create a sovereign wealth fund. Intel in a filing warned of “adverse reactions” from investors to the deal.

Trump fires Fed Governor Lisa Cook. In a letter Trump posted on Truth Social, the U.S. president said the decision, which he determined has “sufficient cause,” is “effective immediately.” The move will likely lead to a legal clash.

Countries with digital services tax will attract ‘substantial’ new tariffs, vows Trump. In addition to tariffs, Trump also said in a Monday post on Truth Social that he would restrict chip exports to those countries.

U.S. stocks lost steam on Monday. All three major indexes fell, giving back some of Friday’s gains. On Thursday, Interactive Brokers will replace Walgreens Boots Alliance in the S&P 500. Across the Atlantic, Europe’s Stoxx 600 lost 0.44%.

[PRO] Consider this Nvidia derivative, CIO says. Nvidia earnings, out Wednesday, are in the limelight this week. But one chief investment officer thinks it’s worth looking at a Nvidia partner also benefiting from artificial intelligence.

And finally…

Traders work on the floor of the New York Stock Exchange on Aug. 22, 2025, in New York City.

Spencer Platt | Getty Images

Markets are sure the Fed will cut in September, but the path from there is much murkier

Friday’s booming rally turned into Monday’s reality check as investors weighed just how aggressive the Federal Reserve will be on lowering interest rates and how the moves might impact the broader business and economic climate.

At this time a year ago, the central bank entered an easing mode that ended up having unintended consequences — an inverse move in Treasury yields and mortgage rates pushed by worries that the Fed might be taking its foot off the brake too soon along with expectations for stronger economic growth.

— Jeff Cox